The point at which a small business’s sales exactly cover its expenses is called The Breakeven Point. Performing a calculation called a break-even analysis can help business owners determine the amount of product they must sell to generate a profit. Knowing your Breakeven Point is crucial for selecting product and service pricing and adjusting operating costs when necessary. To calculate your Breakeven Point, you must know your fixed costs, variable costs, and the selling price of your product or service.

Fixed Costs

Fixed Costs are the operating costs of a business independent of its sales. These costs may include rent or mortgage, insurance, salaries, and property tax. Usually, these are expenses that your business must pay whether or not it is generating an income. These costs likely won’t change no matter how many sales you make.

Variable Costs

As their name implies, variable costs can change and fluctuate. Variable costs are expenses based on the units a company produces or sells. These costs may include labour, commissions, raw materials, shipping fees, and supplies. Variable costs will fluctuate based on the number of goods you sell.

Cost of Goods Sold (COGS)

Simply put, the cost of goods sold refers to all the direct costs when creating your product. This is a type of variable cost. Tracking this line on your income statement gives you key insight into financial performance and the profitability of your products.

Breakeven Point

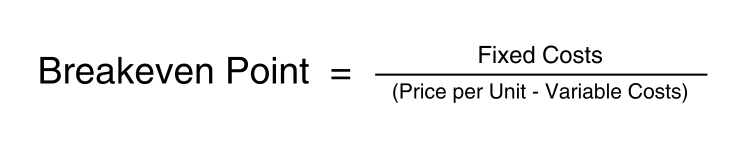

The Breakeven Point is calculated by dividing the total Fixed Costs by the difference between the unit price and the Variable Costs. Included in the Variable costs are your COGS.

Breakeven Analysis is only one aspect of cost-volume-profit (CVP) analysis, but an essential first step when determining a sales price that ensures profit. Download this helpful Breakeven Analysis guide for free from BusinessLink and it will walk you through calculating your break-even point!

Community Futures Wild Rose is dedicated to empowering small businesses to grow. For assistance, you can contact us by email at